Picking that perfect health insurance policy for an individual can be a nerve-wracking experience altogether. The requirements within these plans and their different combinations can confuse any person easily. Some plans may look extremely lucrative, yet when you calculate the premiums plus added costs, the entire estimate suddenly turns upside-down.

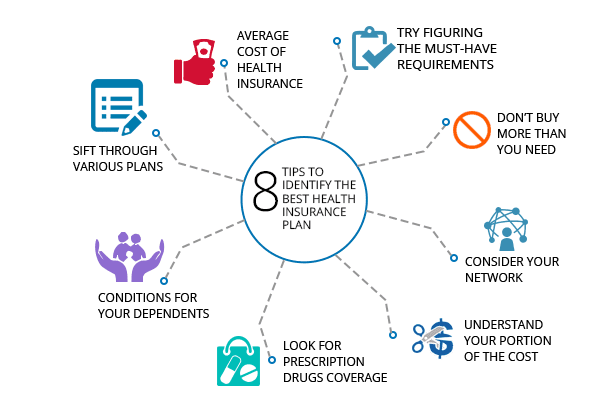

Health care costs can be so daunting that if health insurance plans are not bought carefully, you may end up paying a huge amount for your medical care. Try to note these 8 points, which will help you buy the most appropriate health care plan for you and your family:

Average cost of health insurance

Check how much should be your average cost according to the state and the specific plan you choose. The same plans have different cost components based on their application location (state). You can compare different health plans and can choose low cost health insurance plans. Just because you have seen the plans, does not mean same figures will be applicable across all states.

Try figuring out the must-have requirements

You won’t be able to predict when you will meet with an accident or fall ill. However, certain medical ailments can be foreseen. For instance, any kind of genetic disorder related cost assumptions must be done. Certain illnesses like cardiac issues, old age diseases like arthritics, Alzheimer, Parkinson, hypertension, blood sugar must be included in your plan. Maternity, post-natal cures, vaccinations for the children, etc. must included in the plan.

Don’t buy more than you need

Just because you see some expensive lab tests included within a plan, does not mean you will need to buy that plan. Get yourself covered with the most basic and essential requirements first. The goal is to take precaution not study the entire list of illnesses recorded in a medical illness directory and go overboard protecting you from at least 80% of those.

(If you are a hypochondriac, it’s better someone else in the family sits looking at the illness list).

Consider your network

If you have been under any particular physician, it is better you identify a plan that includes him/her. In case you like a certain plan matching your criteria, look to include those physicians mentioned in that network as your physician. Out-of-network costs will mostly not be covered by insurers. Check out the health insurance company physicians’ directory to look up the doctors listed in them.

Understand your portion of the cost

Prepare to be taken for a ride if you do not ask your plan providers to be transparent about cost sharing outright. How much within the plan is out-of-pocket, how much are deductibles from your pocket – you need an absolutely clear understanding.

Look for prescription drugs coverage

In case you aren’t aware, prescription drugs too can cost you a fortune. Thankfully, there are plans that cover a list of medicines, even the ones you take often.

Conditions for your dependents

In case you have children below 26 years and are either studying or working without their employer coverage cap, you can include them in your plan. Even your dependents with pre-existing conditions are entitled to your health insurance coverage.

Sift through various plans

How much time does it actually take to check a plan in detail? Probably a minute or two. Buying a health insurance plan cannot be compared to your other shopping. No matter how attractive the plan looks on the surface, you must read deep into its details before you make the decision to purchase it. Consult a health underwriter in case you do not understand different divisions within a plan.

Buying suitable health coverage may seem a gruesome task in the beginning. However, once you have taken care of understanding the finer details within any plan, you are all set to make a decent choice for yourself. The above mentioned 8 tips will certainly help you navigate the hurdles.