Contents

Video

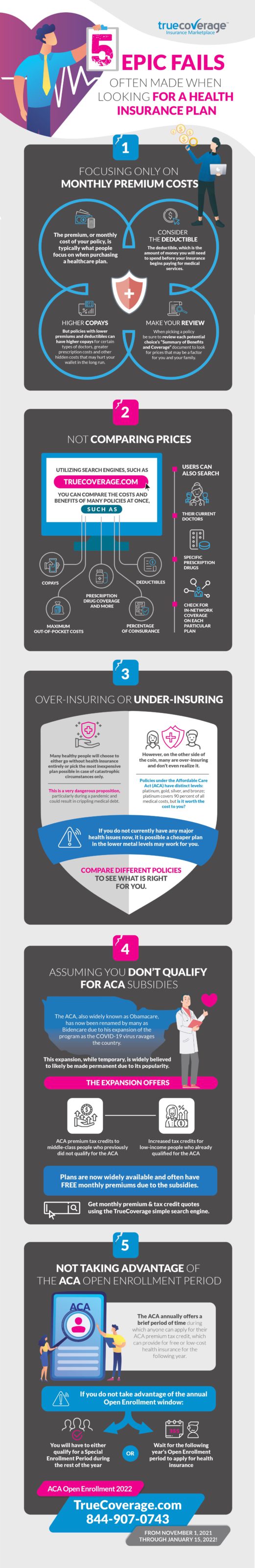

Not Comparing Prices

Utilizing search engines, such as the one TrueCoverage.com provides, you can compare the costs and benefits of many policies at once, such as deductibles, maximum out-of-pocket costs, percentage of coinsurance, copays, prescription drug coverage, and more. Users can also search for their current doctors and specific prescription drugs to check for in-network coverage on each particular plan.

Over-Insuring or Under-Insuring

Because they are healthy now, many people will go without health insurance entirely or choose the most inexpensive plan possible, like an insurance policy for “catastrophic circumstances” only. This is a very dangerous proposition, particularly during a pandemic, and could cause crippling medical debt. However, many are over-insuring and don’t even realize it on the other side of the coin.

The Affordable Care Act (ACA) policies have distinct levels: platinum, gold, silver, and bronze; platinum covers 90 percent of all medical costs, but is it worth the cost to you? If you do not currently have any major health issues now, it is possible a cheaper plan in the lower metal levels may work for you. Compare different policies to see what is right for you.

Assuming you Don’t Qualify for ACA Subsidies

The ACA, also widely known as Obamacare, has been renamed by many as Bidencare due to his expansion of the program as the COVID-19 virus ravages the country. This expansion, while temporary, is widely believed to be made permanent due to its popularity. The expansion provides ACA premium tax credits to middle-class people who previously did not qualify for the ACA and increases the tax credit for low-income people who already qualified for the ACA at a higher cost, making plans widely available and often with free monthly premiums with the subsidies. Find out the amount of ACA subsidy you qualify for on TrueCoverage’s search engine.

Not Taking Advantage of the ACA Open Enrollment Period

The ACA annually offers a brief period of time during which anyone can apply for their ACA premium tax credit, which can provide for free or low-cost health insurance for the following year. Suppose you do not take advantage of the annual Open Enrollment window. There, you must either qualify for a Special Enrollment Period during the rest of the year or wait for the following year’s Open Enrollment period to apply for health insurance

Infographic