Mississippi Health Insurance

Affordable MI Health Insurance Options

It is time to research affordable Mississippi health insurance options for next year! If you and your family live in Mississippi you face the uncertainties of an upcoming Presidential election and the COVID-19 pandemic. Selecting the BEST insurance at the lowest rates is more critical now than ever.

TrueCoverage provides helpful resources and guidance for selecting affordable health insurance that meets your specific needs. Remember, the Open Enrollment Period starts November 1st and runs through December 15th .

Select your Mississippi Health Insurance coverage soon, and you will save yourself last-minute headaches. The TrueCoverage team is here to help by providing pre-registration services. We will contact you with health coverage packages tailored to you, your family, and your small business.

Small Business Health Insurance in Mississippi

Suppose you own a small business in Mississippi (between 2-50 full-time-equivalent employees (FTEs)). You can purchase qualifying coverage for your employees through the Small Business Health Option Program (SHOP) or, just as with individual plans, through a private insurance broker or insurance agent. Typical policies are for 4-6 employees.

If you contribute to your employees’ premium costs, you will qualify for business tax credits. For a full description of the advantages of employer-sponsored health insurance plans, see truecoverage.com/small-business-health-insurance.

Exploring Affordable Health Coverage in Mississippi

When looking for cheap health insurance in Mississippi, the first thing you should understand is that policies with the lowest monthly payments (your insurance Premium) might not be your best option.

The REAL price of health coverage depends on many variables. Deductibles, co-insurance, and co-pays increase costs, while discounts like premium tax relief and a state insurance subsidy can LOWER your medical expenses. A premium might look high at first, but the total amount you spend on medical services could be much lower!

For those over 65 shopping for Medicare add-ons, Mississippi has many options. Mississippi has an average rate of Medicare enrollment (7%). Original Medicare covers basic needs. Medicare Advantage and Medicare supplemental plans could save you a LOT of money.

10 Health Services Mandated for all ACA-Compliant Plans

Before the Affordable Care Act, insurers could refuse to cover various health benefits, resulting in overwhelming debt for many.

The ACA fixed those loopholes and mandated that all ACA-qualifying plans include these coverages:

- Emergency services

- Prescription drugs

- Ambulatory patient services (hospital services that don’t need an overnight stay)

- Hospitalization

- Laboratory services

- Maternity and newborn care

- Pediatric services (for children), including dental and vision care

- Mental health and substance abuse services

- Preventive and wellness services, including chronic disease management

- Rehabilitative/habilitative services and devices

Mississippi, The Metal Health Insurance Tiers and You

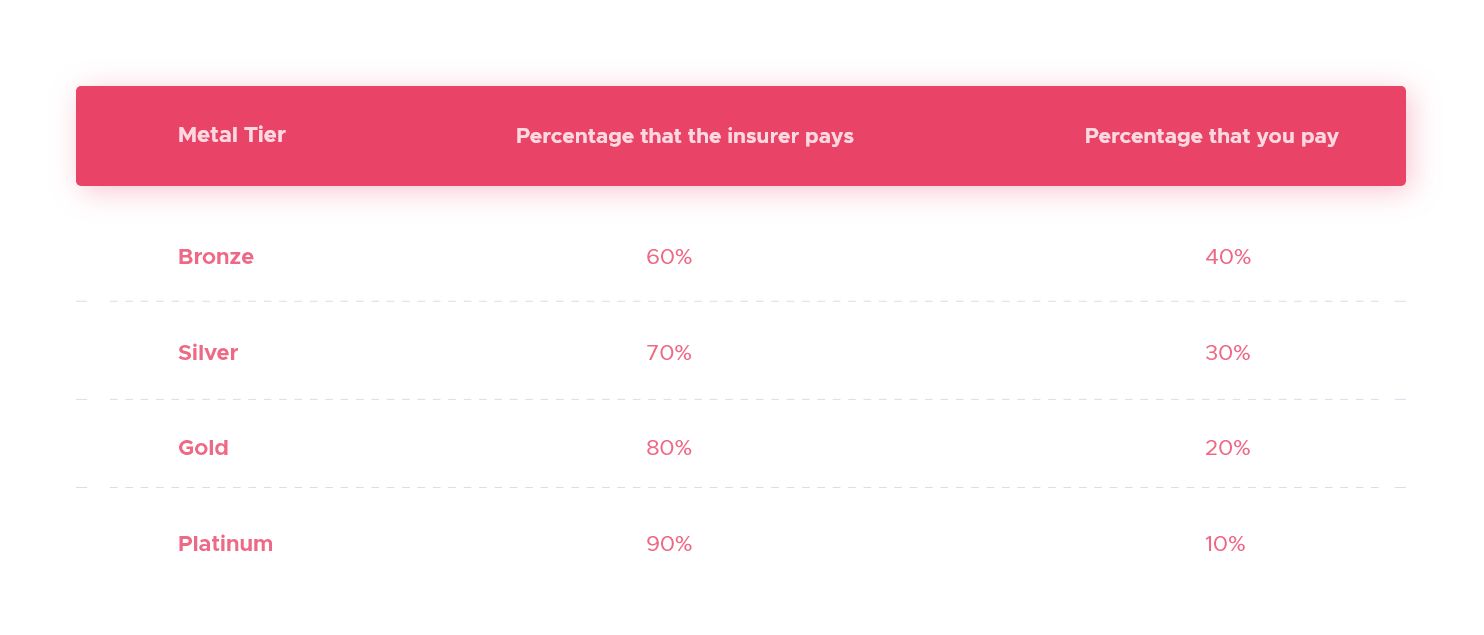

There are four ‘metal’ tiers: Bronze, Silver, Gold, & Platinum. These ‘metal’ categories define how you and your insurance company split your health care costs. Each refers to the portion of medical expenses you must pay besides your premiums.

They have nothing to do with the quality of your health care.

Quick Note: Not every insurance company offers all Metal tiers in every state and region. If they provide health insurance in your area, at the very minimum they will offer the Silver and Gold tier plans.

Below is a breakdown of costs for each metal tier. The percentages are averages estimated by your insurer, easy rules for out-of-pocket expenses. Your costs will vary: these are EXAMPLES ONLY.

Which Metal Tier is Right for You? Choosing the Right Health Insurance Plan

When choosing a health insurance plan, the last thing you want to do is choose a low premium, only to find yourself stuck with medical debt later. But there’s also no reason to pay for a high-value plan if you rarely use medical care.

When comparing plans, the most significant factor to consider is whether you and your family have recurring medical issues or expenses. If so, choose a Metal tier or healthcare plan that pays for more of those expenses.

Silver plans have been the most popular in the federal marketplace and state exchanges. 70% of consumers choose them. But the best way to plan is to think about last year’s medical expenses and select the situation matches yours most closely.

Bronze

- You rarely get sick or need medical services: besides an annual checkup and one or two medications, you can easily pay for out-of-pocket

- You are very healthy

- You are not elderly

- If buying a family plan, your children are elementary-school age or older, very healthy, and do not participate in risky activities.

Silver (Most Popular! Often qualifies for Premium Tax Credits and insurance subsidies)

- Your family members’ one or two mild conditions require medication and specialist visits but do not need close monitoring or frequent care

- Your family members are healthy

- You are under 70

- All your children are elementary-school age or older, healthy, and play few or no sports that often cause injury (the term “sports that often cause injury” is vague, but presume it includes MOST sports and athletic hobbies).

Gold

- You or a family member has a chronic condition, sees doctors often, or needs expensive medication that would be impossible to afford out-of-pocket

- Your children are too young for elementary-school, needing frequent pediatrician visits

- You are older or at a higher risk for colds and flu than most people.

Platinum

- You or a family member has an expensive chronic condition and takes several medications

- You seek urgent care or emergency care more than once per year, frequently need exams to manage a condition, or see doctors more than once per month

- You are older or at high risk for colds, flu, or injuries.

Cost-sharing reductions make Great Health Care possible for everyone

The MI Health Insurance Marketplace offers cost-sharing reductions (CSR) that are “extra savings” opportunities: discounts that lower the total amount you pay for health insurance deductibles, copayments, and coinsurance.

Once qualified for the additional cost-sharing reductions you must enroll in a Silver Metal tier health plan. The Silver plans in Mississippi are the ONLY plans that receive these “extra savings.”

When you fill out the Marketplace health insurance application, you’ll discover if you qualify for premium tax credits and extra savings.

CLICK HERE to see if you qualify for a Health Insurance Subsidy!

You can use your premium tax credit for ANY plan in the Metal Tier category. But if you also qualify for the extra savings, these will only apply to the Silver plans.

With a silver plan you will also have a lower annual out-of-pocket maximum. After you reach your out-of-pocket maximum, your insurer pays 100% of the covered services.

Note: If you are a member of a federally recognized tribe or an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder you may also qualify for additional cost-sharing reductions.

The Coronavirus Pandemic, COVID-19 Testing, and the FFCRA

COVID-19 is a hot topic health insurance issue in Mississippi. If you lose your health insurance due to COVID-19 or your employer closed because of the Coronavirus, testing is available at no charge. The Families First Coronavirus Response Act (FFCRA) passed in March 2020, ensures that everyone can receive COVID-19 testing. You also qualify for an SEP (Special Enrollment Period)

Read our blog: Lost your job due to Coronavirus? 5 ways to get Health Insurance

See the 5 top Mississippi health insurance companies at the bottom of this page.

Key Details about Health Insurance in Mississippi

- Mississippi protects consumers from balance, ‘surprise’ billing

- For more details, see our Blogs:

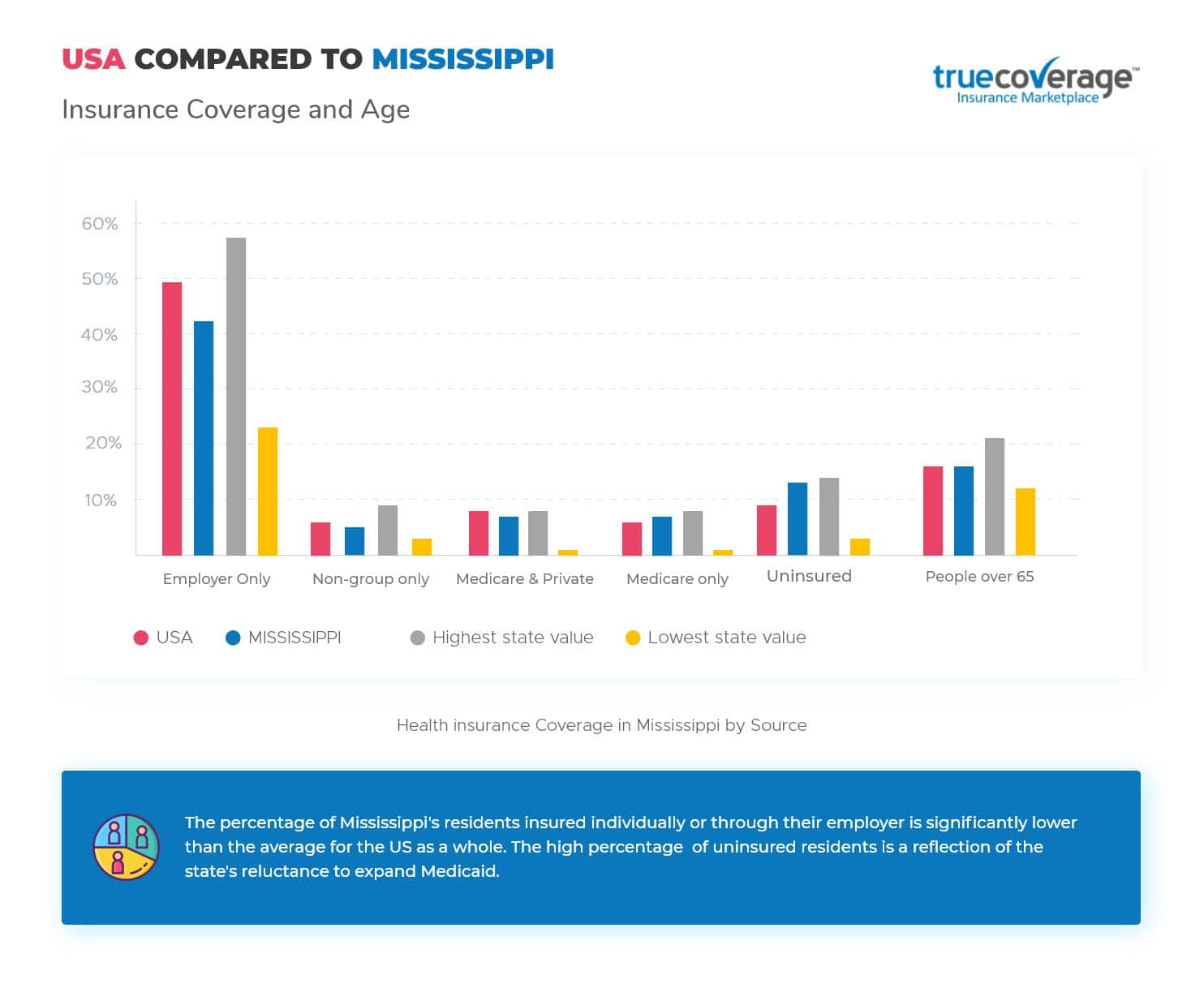

Mississippi is one of the few remaining states which has not expanded Medicaid.

Exploring the Mississippi Health Insurance Marketplace

Mississippi residents can sign up for health insurance using private insurance exchanges. These marketplaces offer more choice of ACA-compliant plans than the state exchange.

With Health Insurance Exchanges like TrueCoverage, you gain access to ancillary insurance such as:

- Dental

- Vision

- Accidental Death

- Critical Illness

- Disability

- Life

- Medicare Advantage, Medicare Supplemental

Benefits of Working with a Health Insurance Broker

TrueCoverage is a Certified Direct-Enrollment Partner of Healthcare.gov. We offer more affordable health insurance plans than any other resource in MI, and our unique technology quickly delivers the ‘BEST VALUE’ insurance policies that address your needs.

Like brokers in every state, TrueCoverage operates without bias. Our job is to find you the best health insurance options, regardless of the insurance carrier. Brokers search for policies that best meet your needs. We are there for you throughout your contract. For example, if a dispute arises with your insurer, TrueCoverage steps in to help.

TrueCoverage is familiar with your state’s unique insurance rules, and we understand the Mississippi health insurance options from the largest carriers to the smaller specialty health insurers.

The Top 5 Health Insurance Companies in Mississippi

Choosing from over 50,000 plans is daunting without independent, expert advice. That is where TrueCoverage shines. To help, we have listed the top five health insurance companies in MI.

Gathered by the National Committee for Quality Assurance (NCQA), these ratings use Consumer Satisfaction, Preventive Care, and Medical treatment options to determine the score.

More details about the top 5 health Insurance companies in Mississippi

The NCQA rates these ACA-compliant health plans as the BEST in Mississippi:

- Scott and White Care Plans

- Aetna Health Inc (Mississippi)

- Community First Health Plans, Inc

- Humana Health Plan of Mississippi

- Blue Cross and Blue Shield of Mississippi

- All ACA-compliant and Medicare plans have a star rating based on similar criteria.

Click below to learn more:

- ACA-compliant STAR plans

- Medicare STAR plans

NOW is the best time to select your ACA Affordable Mississippi health insurance, BEFORE Open Enrollment starts on November 1st.

Connect with the health insurance experts at TrueCoverage now to find the BEST health insurance for you, your family, and your business.

Looking to find affordable health insurance?

Click on the button below to and connect with our agent to get insurance in 24 hours.

Mississippi uses a Federally facilitated health insurance exchange. This Exchange does NOT regulate short term health insurance plans. While short term plans have their usefulness, they are NOT bound by the Affordable Care Act mandates and are NOT eligible for premium tax relief.

Mississippi is joined by twenty other states in an attempt to invalidate the Affordable Care Act (Obamacare). The case is currently before the courts. Rest assured any ACA compliant plan you choose (open enrollment November 1st– December 15th) for 2021 will be valid.

Did You Know?

Meaning ‘big river’ in the Ojibwe language, the Magnolia State became the 20th state in 1817.

Fun fact

Coca-Cola was first bottled in 1894 in Vicksburg, whilst root beer was invented shortly thereafter in 1898 in Biloxi by Edward Adolf Barq Sr. His company is now owned by Coca-Cola! 85 miles away in Leland, where ‘The Muppets’ creator Jim Henson spent his childhood, you can find the ‘Birthplace of Kermit the Frog Museum’.

Sources: National Geographic; Infoplease; 50states