Life Insurance is essentially about securing the financial welfare of your dependents in the event of your death or some other event such as an accident or critical illness.

Term Life (Family and individual)

A term life insurance policy provides cover for a fixed term, normally between 10 and 30 years but may be linked to a mortgage redemption or retirement date, when a pension becomes payable.

Term life insurance costs are relatively inexpensive but premiums are higher for policies started later in life.

- Level premium

During the lifetime of the policy the premium will remain level. At the end of the term you may have the option to renew (without another medical exam) but the premium may rise

- Annual renewable term

These policies may be renewed annually for a fixed period e.g. 20 years. The premiums will increase over time but this may match your income growth

- Return of premium

These policies are relatively expensive but if no claim is made before the policy expires the whole value of the premiums paid will be returned to the owner.

Some of the most requested “riders” (personalizations) are described below but there is no better choice than to discuss your circumstances with our licensed insurance agents.

When considering your insurance portfolio you need to consider the effect that a sudden loss of income would have on your dependents. Within the term of your insurance this could be brought about by an accident, or a critical illness. Unexpected costs such as medical or home-care can seriously affect your household expenses. Events like these can be included in your plans.

You should also consider Joint policies, especially if you and your spouse are both earners and even a short-term loss of income would seriously affect your dependents’ welfare

Group term life insurance

This is term life insurance (see above) for groups of people (affinity groups) such as employees of a company, members of a club or an association. There are two major advantages. First the insurer will normally offer favorable terms to the group as a whole, proof of individual insurability is not normally required e.g. medical assessment. Secondly, the best term life insurance companies generally allow members leaving the group to maintain their coverage.

The disadvantage is that you might not have the same flexibility you would have as an individual to choose personal contract terms or the insurer.

Before making a decision, take into account any existing policies and your future aspirations.

Permanent Life

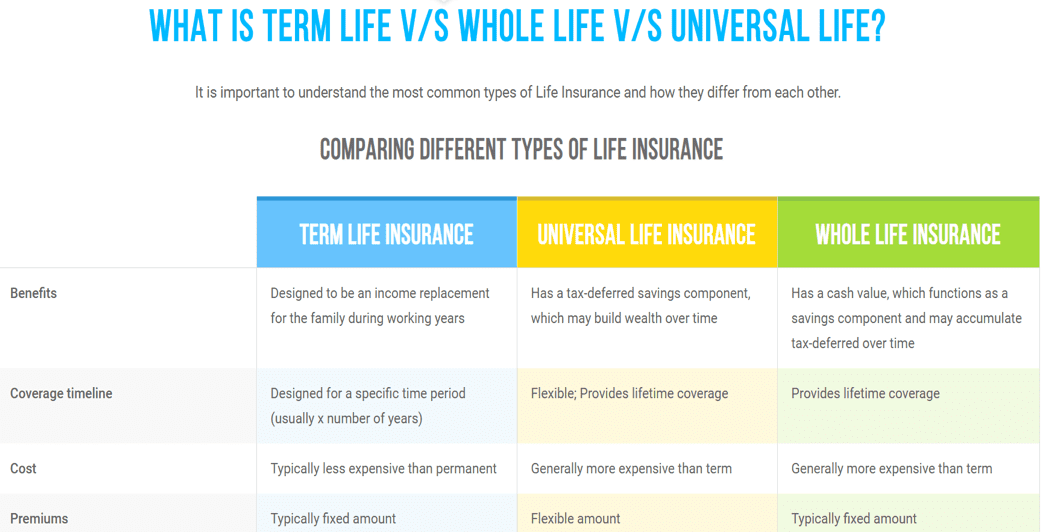

As the name implies a PERMANENT LIFE policy covers the remaining life of the insured. Permanent life policies accumulate a cash value over their lifetime. For this reason, permanent life insurance premiums are higher than for term life but the owner can access the funds before maturity either by securing a loan on the cash value, withdrawing some or all of the cash, or by surrendering the policy for its cash value (the surrender value).

Whole life insurance

Whole life insurance is the simplest form of permanent life coverage. Monthly premiums remain fixed for the life of the policy and depend on the face value of the policy and the age of the insured.

For high face values, and/or older clients, insurers may require a medical assessment.

Universal life*

Universal life insurance coverage is a more complex. Policies combine protection with investment. There are many variations. One of the most popular is Variable Universal Life (VUL) which offers a guaranteed death benefit and an equity-based surrender value. Of course, equity values may rise or fall and for this reason the surrender value of your policy may do the same but the death benefit is guaranteed.

Endowment policies*

Endowment policies combine the flexibility of low term life insurance cost with the advantages of permanent life coverage. These policies are designed to pay a lump at the end of the specified term OR on the death of the insured. Unlike term life insurance policies, endowment policies accrue a surrender value, which can be profit sharing (with the insuring company) or index linked.

*These policies combine protection (insurance) with investment (profit sharing or index linked). TrueCoverage works only with ‘A’ rated Insurance Companies. Talk to one of our licensed insurance agents for more details.