Contents

Racial & low-income family healthcare disparities remain

Although the percentage of Americans without health insurance is far below what it was a decade ago, it’s been rising since the end of 2016. And significant racial health disparities remain: Native Americans and Hispanics are significantly more likely to be uninsured than Whites, as are African Americans and Hawaii Natives.

Although racial health disparities have narrowed since the Affordable Care Act was implemented, a lack of health coverage continues to be associated with poorer health outcomes.

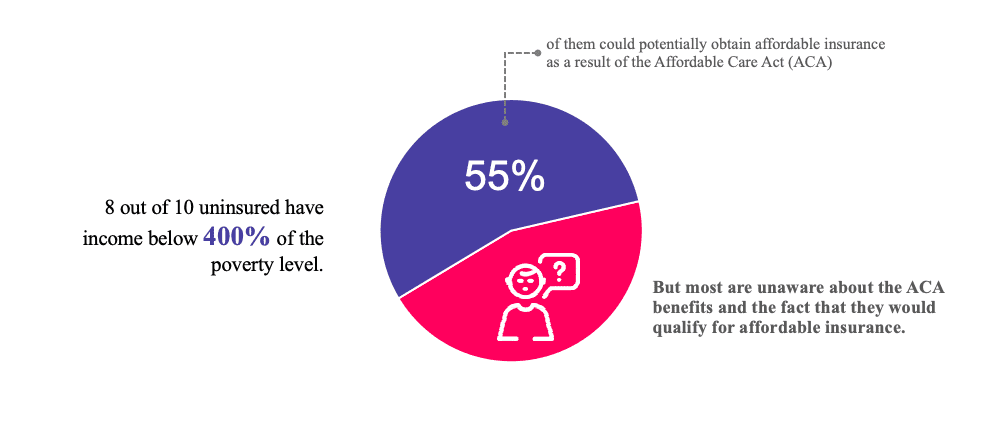

In addition to people of color, lower-income Americans are also much more likely to be uninsured: More than eight out of ten uninsured Americans have income below 400% of the poverty level.

Uninsured often unaware of the benefits the ACA provides

An estimated 45% of the uninsured population is not eligible for financial assistance under the ACA, due to the refusal of some states to expand Medicaid, lack of adequate immigration documentation, or an income that makes them ineligible for subsidized premiums in the exchange.

But while the other 55% could potentially obtain affordable insurance as a result of the Affordable Care Act, there is often a lack of understanding about average medical insurance costs and the ACA benefits that are available to them.

Matthew Goldfuss, Director of New Business Development for TrueCoverage, has personally enrolled over 5,000 people in health coverage. Based on his experience helping people enroll, Goldfuss notes “you’d be surprised how many people are still not aware of all the benefits of the ACA this many years into it. Many of our enrollees are shocked to hear that they can get plans as cheap and benefit-rich as that is available.”

Talk to Matthew Goldfuss to know more

The direct financial benefits provided by the ACA extend well into the middle class and apply to a wide range of applicants. If you’re uninsured (or covered by a non-ACA-compliant plan) and on the fence about signing up for coverage for 2020, consider these benefits, many of which are still widely misunderstood:

Premium subsidies keep coverage affordable

For starters, the ACA includes fairly generous premium tax credits (also referred to as premium subsidies) that are designed to keep premiums affordable. A common misconception is that the subsidies are designed for people who need low-income health insurance, but subsidy-eligibility actually extends well into the middle class.

For a family of five purchasing coverage for 2020, premium subsidies are available with a household income of over $120,000 (that’s four times the poverty level). A single individual will qualify for premium subsidies with an income of almost $50,000. And the government takes a fairly generous approach to calculate income when it comes to subsidy eligibility: Contributions to pre-tax retirement accounts and/or a health savings account are subtracted from your income, making it possible for people who earn even more than these limits to qualify for premium subsidies.

For people on the lower end of the income spectrum, premium subsidies tend to be quite large, resulting in very low-cost insurance. Some enrollees are finding that their premium subsidies are so large that some of the available health plans are actually free after the subsidy is applied.

Call to find our right subsidy for you.

This is because of the way insurers have dealt with the lack of federal funding for cost-sharing reductions: In most areas, they’ve added it to the premiums for silver-level plans, resulting in much higher silver plan rates.

Since premium subsidies are based on the cost of a silver plan, the subsidies are much larger than they used to be. Those subsidies can be used to buy plans at any metal level, and in some areas, they’re large enough to completely cover the cost of a bronze plan—or sometimes even a gold plan.

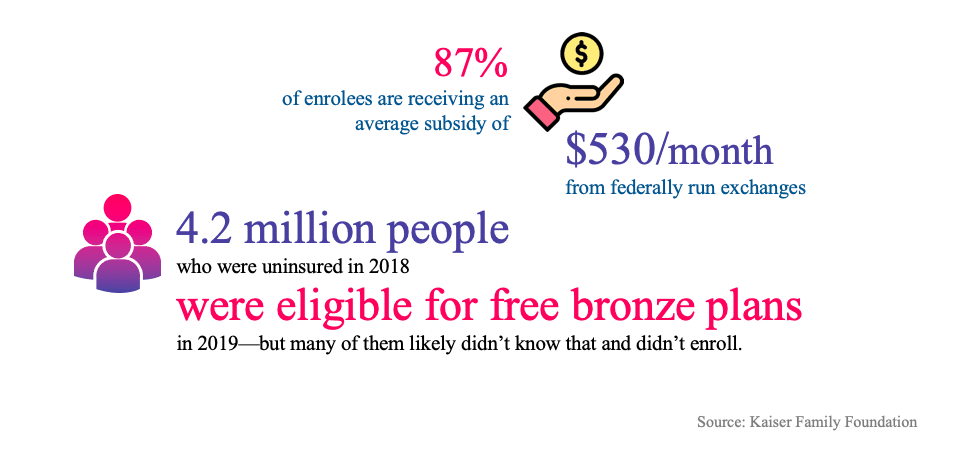

According to an analysis by the Kaiser Family Foundation, 4.2 million people who were uninsured in 2018 were eligible for free bronze plans in 2019—but many of them likely didn’t know that and didn’t enroll.

Plenty has been written about the nuances of all this, but the short story is that premium subsidies are huge: In the states that use the federally-run exchange (that’s most of the country), they average $539/month in 2019, and 87 percent of enrollees are receiving them.

Pre-existing conditions are covered

Prior to 2014, in most states, people buying their own health insurance had to contend with medical underwriting. Pre-existing conditions were often excluded or the basis for coverage offered with a higher-than-standard rate. And some applicants were rejected altogether.

Short-term health insurance still uses medical underwriting, but ACA-compliant plans do not (this includes plans purchased in the exchange or outside the exchange). Medical history is no longer a factor in premiums or eligibility, and pre-existing conditions are covered as soon as the policy takes effect.

Although pre-existing conditions are covered on all ACA-compliant plans, people with pre-existing conditions do need to pay attention to provider networks and covered drug lists, to make sure that their current treatments will be covered under the new plan.

Enhanced coverage for Native Americans

Native Americans with income up to 300% of the poverty level (that’s more than $36,000 for a single person) can enroll in health plans through the exchange that don’t have any out-of-pocket costs. So no deductibles, copays, etc. Native Americans can also enroll year-round, without having to wait for open enrollment.

This provision was intended to help reduce racial health disparities for Native Americans. The uninsured rate among Native Americans has declined as a result of the ACA, but it remains much higher than the overall uninsured rate in the U.S.

Medicaid expansion and CHIP

Thanks to Medicaid expansion under the ACA, along with the Children’s Health Insurance Program (CHIP) benefits that pre-date the ACA, many low-income families find that they qualify for free or greatly reduced-cost health coverage.

The majority of the states have expanded Medicaid, which has played a key role in reducing racial health disparities and low-income health disparities.

CHIP benefits are available in every state, with eligibility guidelines that vary from state to state and aren’t necessarily what people might consider “low-income”

For example, CHIP is available to kids in New York whose household income is 405% of the poverty level, which is more than $104,000 in 2019 for a family of four. In Alabama, CHIP is available to kids in households with income up to 317% of the poverty level, which is more than $81,000 in income for a family of four.

Cost-sharing reductions

Cost-sharing reductions (CSR) are available to people with income up to 250% of the poverty level. For a household of two, that’s a little more than $41,000. And CSR benefits are particularly strong for those with income up to 200% of the poverty level (a little under $33,000 for a household of two).

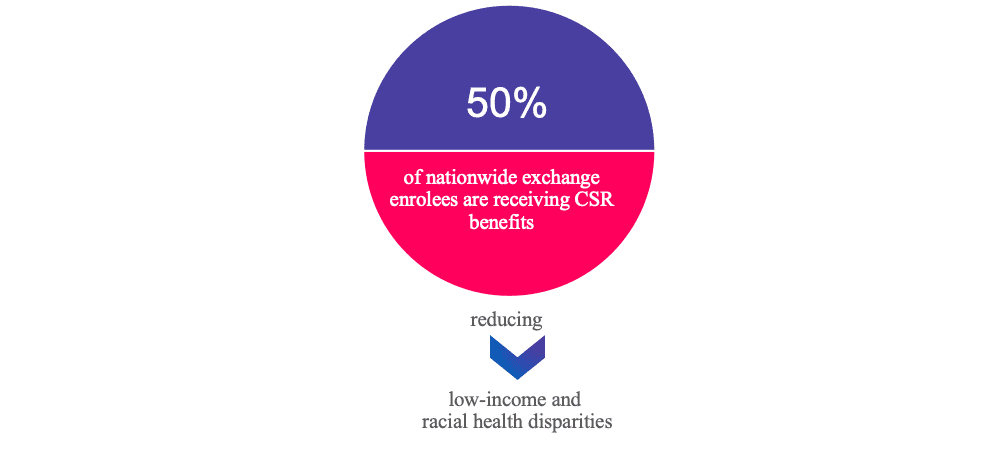

The purpose of CSR is to make coverage for lower-income enrollees more robust than it would otherwise be, with lower deductibles and lower out-of-pocket costs. Half of all exchange enrollees nationwide are receiving CSR benefits, which has also played a role in reducing low-income and racial health disparities.

In order to receive CSR benefits, applicants have to select a silver plan. But the CSR benefits make the plan much richer than a normal silver plan—in some cases, the plan becomes almost as robust as a platinum plan.

Bronze plans tend to be less expensive than silver plans, which sometimes leaves applicants having to decide between cheap health insurance (sometimes even free) and coverage that costs more but also has much lower out-of-pocket costs.

There’s no one-size-fits-all in terms of the right answer here, but it’s important for applicants to carefully consider all of their options before picking a plan.

Premium subsidies + CSR = Substantial benefits

Let’s take a look at some examples of how substantial the benefits are, particularly when it comes to low-income health insurance. We’ll use a 40-year-old earning $23,000/year for these scenarios, and look at health insurance options in different areas of the country:

- In Cheyenne, Wyoming, this person can choose from among three free bronze plans in 2019. Free is obviously fantastic, but these plans have high deductibles ($4,500+) and maximum out-of-pocket costs of $7,900.There is also a free gold plan available to this applicant, with a deductible of $2,000, and a couple of gold plans that cost around $10/month and have even lower deductibles—but their out-of-pocket maximums are still $7,900.However, thanks to CSR benefits, there are several silver plans available with much richer benefits. Their deductibles are only a few hundred dollars, and they cap out-of-pocket costs at $2,600. The trade-off is that these plans are more expensive: About $110-$120/month, after subsidies. But without subsidies, they’d be around $800/month for this applicant. So whichever option the person chooses—free health insurance, cheap health insurance or robust benefits with a higher premium—the ACA is providing a substantial benefit.

- In Charlottesville, Virginia, this applicant can choose from among five free bronze plans, as well as a couple of other bronze plans that are less than $2/month.There is also a gold plan for $62/month, but all of these options have maximum out-of-pocket limits of $7,900, which means the person would be on the hook for up to that amount if they had a serious medical condition during the year.But this applicant can get a silver plan for about $62/month, and thanks to CSR benefits, it has a deductible of just $625 and caps out-of-pocket spending at $2,100.

Those are only two examples, and the bargains vary from one place to another—not all areas of the country have free bronze plans available for low-income enrollees, and free gold plans are fairly rare.

But CSR benefits are available everywhere, and so are premium subsidies that are designed to keep premiums at an affordable level based on the applicant’s income.

People who are uninsured or covered by plans sold outside the exchange have nothing to lose—and potentially a lot to gain—by checking to see what sort of benefits they could get in the exchange.

The exchange website will help them to determine whether they or their kids might qualify for Medicaid or CHIP, and can also help to identify other potential benefits, such as the zero-cost-sharing benefits for some Native Americans, premium subsidies, and CSR benefits on silver plans for some applicants.

Written by: Louise Norris

Louise is the co-owner of Insurance Shoppers, Inc., a health insurance brokerage in Colorado. She writes about health insurance and health care reform for healthinsurance.org, medicareresources.org, Verywell, HSA Store, and Anthem’s Benefits Guide. Her work has also appeared in Health Affairs and she was a panelist for a Brookings Institution event in 2018 that focused on health care reform at the state level.