Health Insurance

Preventative Care is Always a Good Option

The cost of your Medicare health insurance depends on several factors, including the state or county in which you live. It follows that the amount you actually have to pay for your care and treatment, either through insurance or ‘out of pocket,’ depends on individual...

MAKE THE MOST OF YOUR ADVANTAGE

Do you already have a Medicare Advantage plan? When did you first enroll? Have your medical needs changed? Considering this and adjusting your Medicare Advantage plan is essential to ensure you get the best coverage for your current health situation. Do you let...

OPEN ENROLLMENT 2024

What you need to know before you renew your health insurance Coverage and benefits Network types and providers Premiums and deductibles Metal tiers Star rating. How does your plan compare? First, you need to know the start and end dates of open enrollment 2024. (plan...

What is the Purpose of the Metal Tiers in Health Insurance?

CHOOSING HEALTH INSURANCE? First, we need to consider the purpose of insurance, specifically HEALTH INSURANCE. The purpose of an insurance policy is to provide you with financial protection from losses (expenses) resulting from the insured ‘event’ occurring within the...

Does Your Health Plan Have Star Quality?

Why do qualified health plans have star ratings? All ACA-compliant plans (aka Qualified Health Plans or QHPs) with five hundred or more enrollees must have a star rating. The purpose of the star rating is to make it easier for you, the consumer, to make direct...

Planning Your Special Day? Don’t Forget These Essential Tips!

If you are planning a wedding in the next twelve months, you will be in good company. Over two million weddings are held annually in the USA, and that takes a lot of planning. Put another way, two and a half million couples are poring over endless lists—lists of the...

DON’T WORRY ABOUT WORRYING AND TAKE THE STRAIN OUT OF STRESS

LAUGHTER IS THE BEST MEDICINE Stress is not technically a disease. It is the body’s automatic response to a perceived external threat or unexpected change. The response may be physical, emotional, or cognitive, but our early ancestors’ only survival option was...

TELEHEALTH, THE DOCTOR IN YOUR POCKET

Perhaps you may be reading this on your laptop, tablet, or iPhone; WHY? Did someone suggest it? Your doctor? Your pharmacist? A healthcare provider? Your health insurance adviser? A friend? Or just a lucky chance? Whatever the reason, when reading this article about...

WHAT PARENTS SHOULD KNOW ABOUT MEASLES

Is measles dangerous? How contagious is measles? How common is measles in the United States? What can you do to protect your children? The brief answers to these questions are: – Is measles dangerous? YES How contagious is measles? VERY How common is...

THE BEST HEALTH INSURANCE PLAN IS ‘FREE’ YOUR SELF-ENROLLMENT CAN START TODAY

Very few of us live our lives without needing medical care either for ourselves or our family. From first to last, from birth to end-of-life care, we depend on the trained expertise of nurses, doctors, and consultants to enable us to survive the early years of...

HAVE I GOT THE BEST HEALTH INSURANCE ?

AM I SPENDING TOO MUCH?DO I NEED ADDITIONAL COVER?WHAT SHOULD I DO? Ever since you signed up for this year’s health insurance and with every monthly premium payment or paycheck deduction, you probably have one or more of these questions come to mind. Don’t worry; it...

LIFE EXPECTANCY FALLS AGAIN

The terms ‘mortality rate’ and ‘life expectancy’ are often used interchangeably but have entirely different meanings. Mortality rates refer to the number of deaths in a specific ‘population’ related to a particular causation(s). The ‘population’ may consist of a whole...

Are you (or your partner) co-sleeping or planning to co-sleep with your infant child?

For many parents, co-sleeping seems to be the most natural thing in the world. For others, it is the last resort. There are times when co-sleeping (or close proximity sleeping) reinforces bonding and makes breastfeeding less disruptive and more satisfying; at other...

CARING FOR OTHERS? CARE FOR YOURSELF!

If your attention has been drawn to this article, you are probably already the carer of a friend or relative. Possibly, you have a colleague or employee who is a carer whose divided loyalties you share. Most of the statistics concerning caring are based on...

Some tips to improve your sleep quality without medication

There are so many words that describe our need for sleep we could use this page to list them all. But two stand out: Tiredness and Fatigue. We tell someone we feel tired or fatigued, and we feel the need to sleep. Sleep is the nature’s response to...

$0 Health Insurance, Federal Subsidies, and Rewards Programs: Everything You Need to Know

The Affordable Care Act has been a game-changer, opening doors to health insurance for countless individuals and families. One of its most important features is income-based subsidies, designed to make sure health coverage is accessible to a wide range of people....

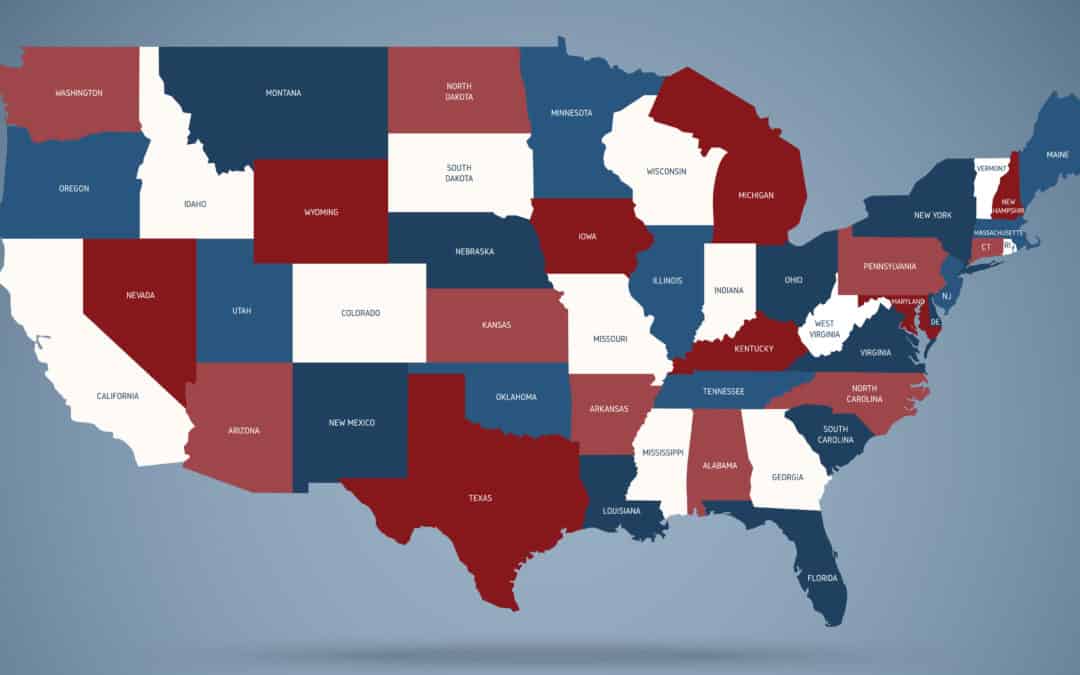

VIRGINIA GOES SOLO

By Open Enrollment in 2023, Virginia will have its “own” Health Insurance Exchange (marketplace). Although every state must have an exchange, most (33) run their marketplace on a federally-run I.T. platform. The other 17 states run on independent platforms of their...

IS MEDICARE ENOUGH TO…?

Provide me with the insurance coverage I need to secure my future well-being. You may be approaching 65 and eligible to sign up for Medicare for the first time. You may be reconsidering your plan(s) for next year, intending to reduce your out-of-pocket costs or...

MEDICAID EXPANSION AND YOU

To understand Medicaid expansion, we have to go back to the days before 1965 when Medicaid was introduced. Until then, the care of older adults, the terminally ill, people with chronic illnesses, and those who could not afford health insurance was in the hands of...

Unveiling TrueCoverage: Your Ultimate Resource for Navigating the Health Care Gov Plan

In the realm of health insurance, the Health Care Gov Plan holds significant importance for individuals seeking comprehensive coverage options. TrueCoverage has emerged as a trusted partner, offering a comprehensive suite of services that encompass being a personal...

Navigating the Health Insurance Marketplace in Texas: TrueCoverage’s Unbiased ExpertAdvice

Introduction: The health insurance marketplace in Texas offers a range of options for individuals and families seeking coverage. Access to unbiased, fair, and free advice is essential in this complex landscape. TrueCoverage, as ab insurance leader, is dedicated to...

TrueCoverage: Your One-Stop Solution for Health Insurance Quotes and More

Introduction: Finding the right health insurance coverage can be daunting, but TrueCoverage is here to simplify the process. As a leading provider of health insurance quotes and ancillary insurance options, TrueCoverage offers individuals and families a comprehensive...

Insurance Online Health: Streamlining Coverage for the Digital Age

In today’s rapidly evolving digital landscape, the search for reliable and affordable health insurance can often be a complex and overwhelming process. However, TrueCoverage, the #1 trusted insurance agency, has emerged as a transformative force in the online...

Health Insurance In The Marketplace with TrueCoverage

When it comes to securing health insurance in the marketplace, individuals and families often find themselves faced with a myriad of options and complexities. The ever-evolving healthcare landscape can be overwhelming, but TrueCoverage is here to simplify the process....

Navigating Health Insurance: TrueCoverage Offers a Solution

Health insurance has always been a complex and challenging part of the American healthcare system. With constantly changing regulations, confusing policies, and an overwhelming number of options, individuals often find it difficult to secure affordable and suitable...TrueCoverage: Revolutionizing Insurance Healthcare through Smart Technology Solutions

Introduction: In the dynamic world of insurance healthcare, finding affordable and comprehensive coverage can often be a challenging and time-consuming process. However, TrueCoverage, a leader in smart insurance technology solutions, has emerged as a game-changer in...

5 Tips to Help You Pick the Right Health Insurance Plan

Are you ready to dive into the world of health insurance? Don’t worry, we’ve got your back! Navigating through the sea of options can be overwhelming, but fear not – we’re here to help. In this blog post, we’ll provide you with 5 tips to...

ACA Subsidies Lower the Cost of Monthly Premiums

Accessible, Affordable, and Attainable One of the key achievements of the Affordable Care Act (ACA) was the introduction of health insurance subsidies. For health insurance bought on the Marketplace, Obamacare subsidies lower the cost of monthly premiums for ACA...

Everything you need to know about The Federal Poverty Level (FPL)

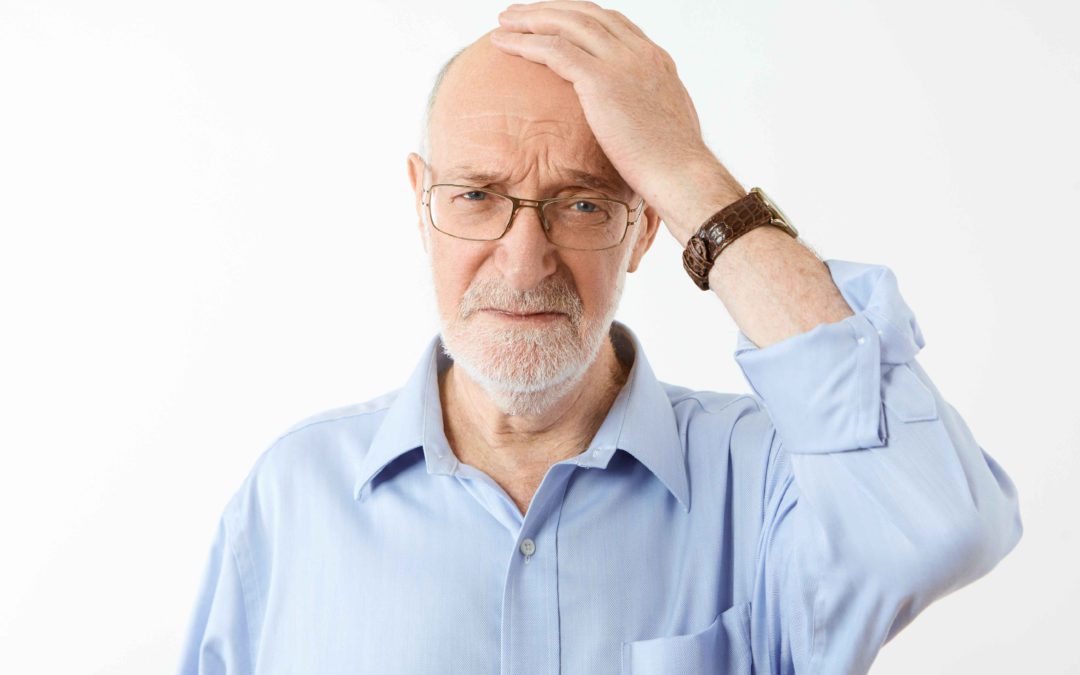

Perhaps you are concerned that a friend, a relative, or yourself are showing signs of having problems with forgetfulness, problem-solving, or communication. Like weakening muscles, stiffening arteries, muscle wastage, and age-related memory failings, these symptoms...

How can I recognize that someone I know, is suffering from Alzheimer’s disease? What should I do?

Perhaps you are concerned that a friend, a relative, or yourself are showing signs of having problems with forgetfulness, problem-solving, or communication. Like weakening muscles, stiffening arteries, muscle wastage, and age-related memory failings, these symptoms...

Affordable Health Coverage Options for the Unemployed

As an unemployed person, you may be able to get an affordable health insurance plan through the TrueCoverage.com insurance marketplace, with savings based on income and household size. Connected to Healthcare.gov marketplace, you can now find out if you qualify for...

Cholesterol, Friend, or Foe?

Your body makes cholesterol naturally. Cholesterol is essential to cell production, certain hormones, vitamin D, and your digestive system. So cholesterol is vital to our existence. At the proper levels, it is your friend. High cholesterol levels are your enemy. What...

Preparing for the first year of marriage is so important

It’s important because you want to get off to a great start. You want to hit the ground running if you will in the right direction. And so I want to share just a few of the things that you should be considering. We have the privilege of being able, from...

FREE Health Insurance if Your Income Doesn’t Exceed 150% of the Federal Poverty Level

Under the new Special Enrollment Period (SEP), eligible applicants can enroll in an ACA-compliant health plan through the marketplace year-round This Special Enrollment Period does not limit the ACA health plan that...

What are Non-Pharmaceutical Drug Treatments for ADHD?

Yes, there are non-pharmaceutical approaches to supporting those living with ADHD-affected loved ones and minimizing their dependence on pharmaceutical drug intervention and the risk of side effects. We spoke recently on what to do if you suspect your child has ADHD,...

It’s Pride Month – Let’s Talk Health Insurance for Same-Sex Marriages

Due to the Supreme Court ruling legalizing same-sex marriage nationwide in 2015, same-sex married couples qualify for the same benefits under the Affordable Care Act (ACA) as heterosexual couples in all 50 states. But despite that fact, many same-sex partners remain...

What Does it Cost to have a Baby in a Hospital?

Nearly 4 million women in the United States will give birth annually and in 2020 alone, approximately one in nine U.S. women of childbearing age was uninsured. If you are insured, the cost of having a baby will require you to first meet your insurance’s deductible,...

Will my Health Insurance Cover Therapy?

According to NAMI, the National Alliance on Mental Illness, an estimated one out of five U.S. adults experience a mental health issue every year. However, many of those afflicted do not seek help for their problems due to a litany of reasons, such as the stigma...

Moving? What a Change in Residence Means for Your Health Insurance

While the 2022 Open Enrollment window for the Affordable Care Act (ACA) ended at the beginning of the year, don’t fret if you haven’t gotten cheap health insurance coverage! We are currently in the Special Enrollment Period (SEP), which allows certain triggering...

Biden Looks to Fix the “Family Glitch” in the Affordable Care Act

The Biden administration recently announced a proposal from the U.S. Treasury Department to fix an issue that has existed in the Affordable Care Act (ACA) since its inception, the so-called “family glitch.” Under the original ACA, a person or family is...

What is Alopecia? (Hair Loss)

For many, the pop-culture debate regarding the slap heard round the world at this weekend’s Academy Awards ceremony has resulted in more questions than answers. Today we will get down to the root of one of those questions; just what is alopecia anyway? Alopecia is the...

Millions to Lose Medicaid & CHIP Coverage as COVID-19 Emergency Ends

Due to the COVID-19 public health emergency, the Families First Coronavirus Response Act was passed in March 2020. This bill required states to halt their standard eligibility checks on current and new Medicaid and CHIP users, which could often result in denials of...

Thyroid Disease Awareness

Did you know that approximately 20 million Americans are affected by some type of thyroid disease? But just what is the thyroid, and why does it matter? The thyroid is a butterfly-shaped endocrine gland in your neck just above your collarbone, wrapped around your...

Five Things You Can Get Free From the U.S. Federal Government

We all pay taxes, and we all resent it. So often, it seems like we get nothing tangible in return. Still, there are many things you can get free of charge from the federal government, here are just a few: 1) Cell Phone – Recognizing that cells phones are essential for...

How to Find Affordable Health Insurance Coverage for Young Adults

If you are currently a young adult, you probably do not remember a time before the inception of the Affordable Care Act (ACA), sometimes called Obamacare. Back then, insurance companies did not have to continue covering you through your college-age years. But one of...

Is pain management covered by health insurance?

What are the risks of long term opioid treatment? Medicare Part A/Part B or Part C Advantage with Drugs coverage or Medicare Part D drugs coverage ensure that prescribed pain management care while part of a medical procedure is included in your plan. Among the drugs...

The 1, 2, 3 Open Enrollment Renewal Process

As we approach the Affordable Care Act’s Open Enrollment period from November 1, 2021, through January 15, 2022, for 2022 plan year coverage, you are hopefully thinking about renewing your policy and any potential changes to be made to...

Which is better, an HMO or a PPO Health Insurance Policy

A Health Maintenance or a Preferred Provider Organization? WHICH IS BEST FOR YOU? We begin with a brief explanation of the differences between these two types of health insurance plans, HMO and PPO, and then discuss some reasons for choosing one or the other. Each has...

When Should I See an Allergist?

If you’re feeling tired all the time, your throat is constantly sore, or you have a stuffy nose and itchy eyes most of the time, then you probably might be experiencing symptoms of allergies. But when should people see an allergist? Read our article on: Do I...

ALS: What does Insurance Cover?

ALS is a neurodegenerative disease that affects nerve cells in the brain and spinal cord. The progressive degeneration of motor neurons in ALS eventually leads to paralysis or death. It’s important to know what your insurance covers before you decide how you...

How Will My Lyme Disease Diagnosis Affect My Health Insurance?

Have you ever checked for ticks after going for a hike or walking through tall grass? If so, you’re probably familiar with the risks of Lyme disease – the most common vector-borne illness in the United States. Every year, over 30,000 people in America will contract...

What Treatment Does Health Insurance Cover For My Child With Autism?

Navigating health insurance can be complex when you’re the parent of a child on the autism spectrum. While the CDC estimates that 1 in 54 children have autism spectrum disorder (ASD), treatment coverage can vary greatly depending on your insurance plan and state of...

How Does My Health Insurance Change If I Adopt a Child?

First of all, congratulations! Adopting a child is a very exciting time in many parents’ lives. The decision to add a new child to the family also comes with a variety of considerations, including health insurance coverage. Rest assured that federal law requires your...

Open Enrollment resumes for 3 months Feb. 15th-May 15th, 2021. Affordable health insurance is now available.

What you need to know for this Special Enrollment Period The Coronavirus pandemic has cost millions of Americans their health coverage as they lost jobs in the economic fallout. To help counteract the economic damage, the Biden administration has reopened the Health...

Private Healthcare Marketplace: What Are the Best and Worst States for Health Care?

The National Committee for Quality Assurance rated health plans in 2019. It looked at a variety of factors, including whether plans were NCQA certified, how satisfied patients were with plans, and how well plans covered and handled both preventative services and...

Top 5 Reasons Why Disability Claims Are Denied

Because filing for Social Security disability can be complicated, it’s not unusual for a claim to be denied at first; however, many of those who are denied initially go on to be successfully approved for benefits. To increase your odds of approval, it’s...

Why Are Not All Drugs Covered Under Health Insurance?

Coverage for prescription drugs can be a complicated part of your health insurance plan. It’s common for a plan to cover at least some drugs, but few plans will cover all available medications. Much of the time, what you pay within your plan will depend on the...

How to Get Antidepressants without Insurance

Depression and anxiety are debilitating mental health conditions that affect every aspect of life. Symptoms can range from irritability and lack of motivation to severe depressive episodes that leave you feeling helpless. For about 10% of Americans over the age of 12,...

ACA Open enrollment guide-How long it takes to enroll?

Open enrollment only lasts about two months each year, give or take — it can be longer or shorter, depending on which state you live in. But even six weeks is more than enough time to compare plans, as well as apply and sign up for health insurance. Preparing ahead of...

The Differences between HDHP and Catastrophic Health Insurance Plans

If you’re looking for health insurance with low premiums, you may think that either a catastrophic health insurance plan or a high deductible health plan will do. But while they may seem like the same thing, these plans differ in many ways, particularly...

How Much Does it Cost to Give Birth if I Don’t Have Health Insurance?

Almost 3.9 million women in the United States give birth each year — and new deliveries don’t come cheap. Even for those who are lucky enough to experience healthy pregnancies, hefty expenses for prenatal, labor and delivery, and postpartum care can (and often...

Can my ACA Health Insurance be cancelled?

Can my ACA Health Insurance be cancelled? If you ask this question because your insurer has threatened to cancel your coverage, or you have reason to think that they might. The short answer is YES. Many things can trigger the cancellation of your policy. ...

The Special Enrollment Period (SEP) Change in Residence

The Affordable Care Act (ACA) has a restricted enrollment period from January 1st until November 1st each year. It is an arbitrary rule for health insurance enrollment, but there is a way to get health insurance outside of this brief period if...

Can You Cancel Health Insurance at Any Time?

Health insurance is one of the most important ways in which you can protect yourself, both from health risks and financial ones. It gives you peace of mind knowing that your medical bills will be covered should you fall ill. While the individual mandate part of the...

Smoking and health insurance. All you need to know

Smoker or not, anyone applying for ACA-compliant health insurance (Obamacare) has to answer the question: Do you use tobacco? Does Smoking affect Health Insurance premium? For those who smoke cigarettes, cigars, a pipe, or chew tobacco, the answer is simple. For those...

Can I Still Go to the Hospital if I don’t have Health Insurance?

What happens if I go to the hospital without insurance? If you’re in good health, you might think you need not spend the money on monthly health insurance premiums. After all, insurance plans can be costly, and it’s hard to rationalize throwing your money...

COVID-19 Health Insurance Options

How can I lessen the chances of being infected by COVID-19? What is the latest advice on COVID-19 protection? What are COVID-19 Health Insurance options? Three questions as we approach Open Enrollment (November 1st) for 2021 ACA (Obamacare) health insurance coverage...

How do you answer question 4? Do you use Tobacco?

As open enrollment comes closer (November 1st)) and you need to contact your health insurance agent looking for your best health plan, you will be faced with four critical questions. Your age?Your location? (many states have different regulations) Do you need an...

7 Facts About COBRA Health Insurance You Should Know

The CONSOLIDATED OMNIBUS RECONCILIATION ACT, ‘Continuation in medical insurance’, was introduced in 2017 to ensure that employees, who are members of an employer-sponsored group health insurance schemes, have a secure route to continued coverage in the event of...

How Much does Health Insurance Cost

There are minimum hundred intermediaries within different health insurance enterprises that offer health insurance plans. The U.S. Health insurance industry is one complicated place, which only the highly experienced and experts are capable of understanding. To...

4 Health Insurance Benefits + COBRA: Lower Employee Stress

Of all other things that keeps me worried, one major concern that remains is- what if I am laid-off by my employer? Losing my job not only stops my earning until I have found myself a new one, but also puts my family’s happy dwelling at stake. Things get worse when I...

7 Things that indicate your Health Insurance Broker is good

Hurry! 14 days have passed since Open Enrollment 2017 has begun. If you haven’t done any research on health insurance requirements, the new rules and strict regulations that have been introduced and penalties for not enrolling into the program, better look for a good...

How does the Federal Health Insurance marketplace work?

The Affordable Care Act (ACA), also referred to as Obamacare, provides for all American Citizens to have access to health insurance underwritten by the US Government. Unless exempted, all American citizens and foreign residents must be covered by health insurance...

Tax and subsidy guidance

The Affordable Care Act (ACA) comes with benefits and obligations. The benefit is that every American citizen has affordable access to healthcare. The obligation is to have sufficient health insurance to meet the Minimum Essential Care (MEC) limit. There is a...

Health insurance basics

Everyone who is familiar with the cost of medical care or the complexities that come with it know that it can be a major headache. From the very moment you enter the doctor’s office, to having your prescription drugs filled, to different lab tests and screenings, to...